Key Insights:

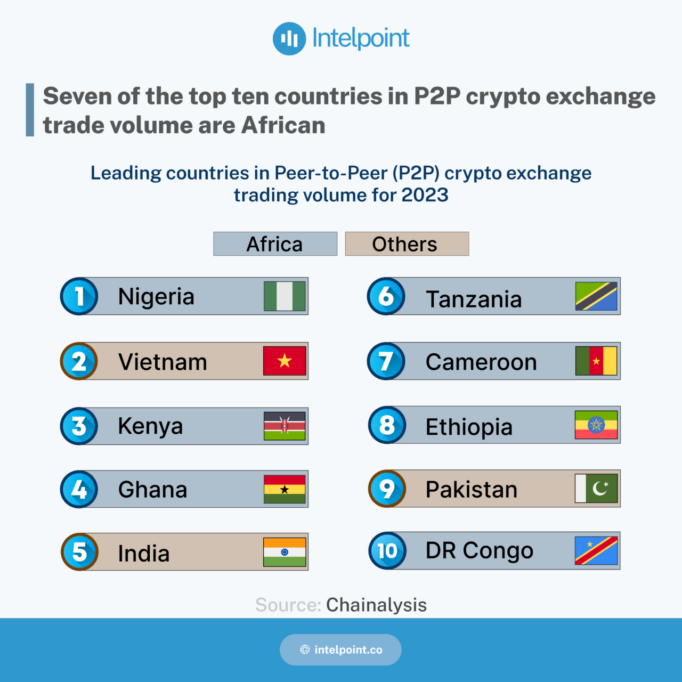

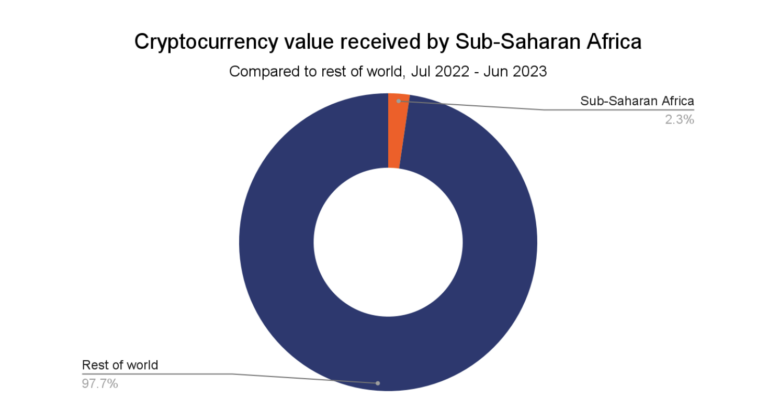

Nigeria stands at the top among 155 countries, boasting the highest P2P volume, and is the largest cryptocurrency economy in Africa, registering the highest cryptocurrency value exchanged between 2022 and 2023. However, Africa, as a whole, received the smallest share of cryptocurrency value globally during this period.

Nigeria has seen a significant rise in peer-to-peer (P2P) exchange volume, as reported in the 2023 Geography of Cryptocurrency Report by Chainalysis.

In 2021, Nigeria ranked 18th in P2P exchange volume but improved to 17th place in 2022. Surprisingly, despite this impressive P2P volume, sub-Saharan Africa contributed only 2.3% to the global cryptocurrency transaction volume from July 2022 to June 2023, making it the world’s smallest crypto economy.

Latin America, another emerging market, accounted for a modest 7.3% of global cryptocurrency transactions. Notably, Brazil ranks among the top 10 countries in the world for crypto adoption.

The question arises: Why are the smallest crypto economies leading in P2P volumes on a global scale? The answer lies in Chainalysis’s methodology, which considers P2P exchange volume in relation to purchasing power parity (PPP) and the number of Internet users. This approach highlights countries where a larger portion of their overall wealth is involved in P2P cryptocurrency transactions.

Without this weighing against PPP per capita and Internet users, the wealthiest countries would dominate the crypto adoption rankings. For instance, North America accounts for the highest crypto transaction value globally at 24.4%, with the United States alone receiving nearly $1.2 trillion in cryptocurrency value.

However, these numbers alone do not reveal the complete story of crypto adoption.

Chainalysis emphasizes that grassroots crypto adoption is about everyday people embracing cryptocurrencies, not just raw transaction volumes. It helps us understand the impact of cryptocurrencies beyond trading.

In the 2022 crypto adoption index by Chainalysis, Adedeji Owonibi, Founder and CEO of Convexity, attributed the increase in P2P transactions in Nigeria to wealth creation and protection against inflation. Inflation in Nigeria reached a historic high of 26.7% since 2005, making cryptocurrencies, especially stablecoins, a refuge for preserving savings.

Nigeria is not alone in this trend. Ghana, ranked fourth in countries with the largest crypto P2P volumes, faces similar inflation challenges, with a staggering 40.1% inflation rate as of August 2023.

Outside of Africa, Argentina has embraced cryptocurrencies due to its ongoing currency crisis, which has led to an 80% decline in the peso’s value against the dollar.

High inflation, low growth, fiscal deficits, and a heavy debt burden have plagued the country. Approximately 5 million Argentines, out of a population of 45.8 million, use cryptocurrencies, reflecting the mainstream adoption of crypto as a solution to economic challenges.

While the data may show that emerging markets have a smaller share of cryptocurrency transaction values, understanding who uses cryptocurrencies and why they use them paints a more comprehensive picture of crypto adoption levels and the potential future evolution of cryptocurrencies.