Decentralized exchange (DEX) Bunni has officially announced a permanent shutdown after suffering a major $8.4 million flash loan hack that crippled its platform in September. The exploit, which targeted the protocol’s liquidity pools, resulted in the loss of nearly all user funds and dealt a severe blow to the project’s operations.

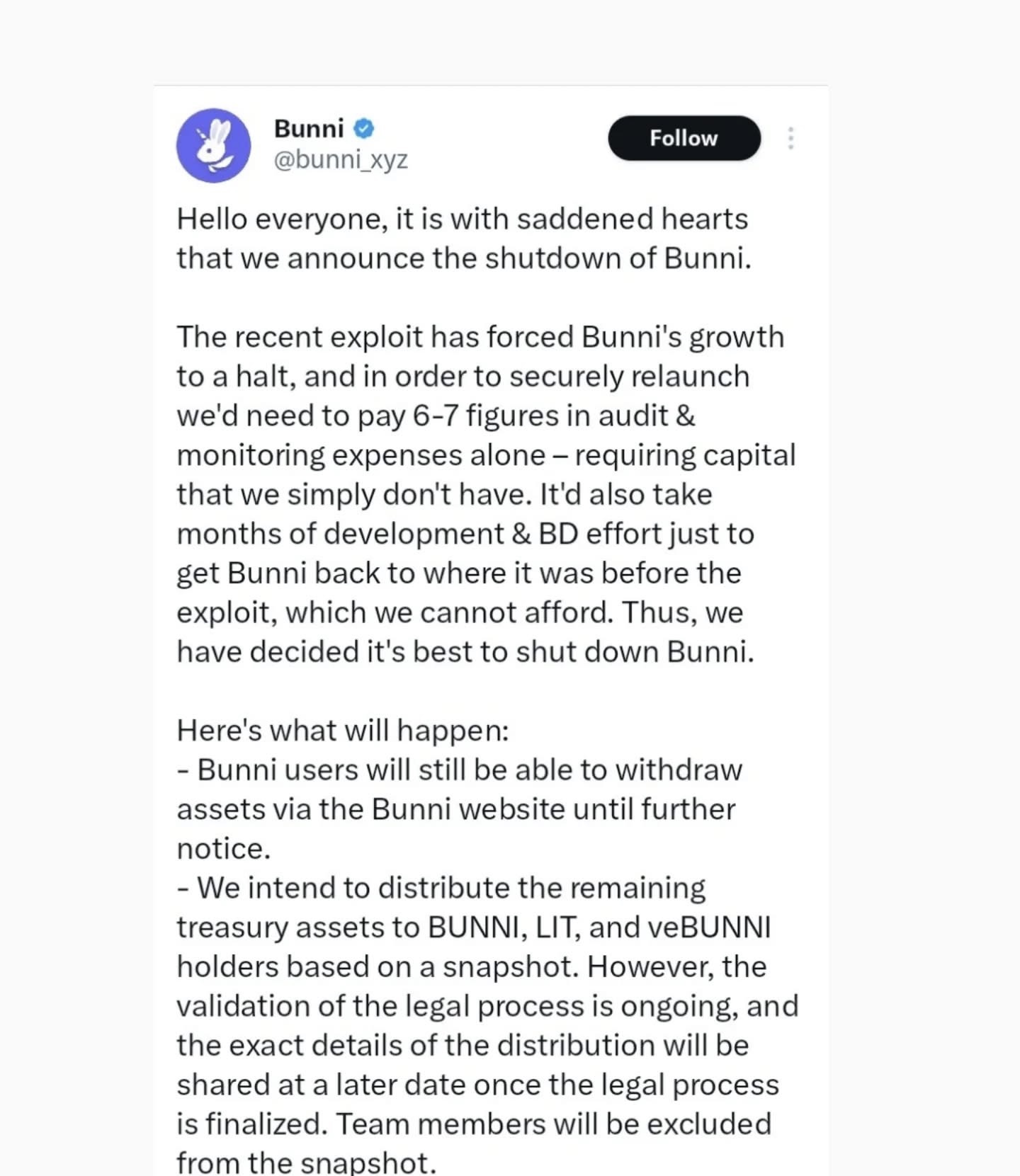

In a statement released by the Bunni team, developers revealed that rebuilding the platform would require a complete overhaul of its security architecture, alongside extensive audits and development work estimated to cost between six and seven figures. The team admitted that such a financial commitment is beyond its current capacity, effectively ruling out a relaunch.

“We’ve explored every possible recovery path, but a secure and reliable relaunch would demand significant funding for audits and development that we simply don’t have,” the statement read. “As a result, we’ve made the difficult decision to wind down Bunni permanently.”

The team has assured users that they can still withdraw any remaining assets as the exchange undergoes a structured wind-down. Additionally, Bunni’s treasury funds will be distributed to affected users as part of the closure process.

The incident adds to a growing list of DeFi hacks in 2025, highlighting persistent vulnerabilities within decentralized finance ecosystems. Flash loan attacks—where attackers borrow and repay large sums of cryptocurrency within a single transaction to manipulate market conditions—have continued to plague DeFi protocols despite improved auditing practices across the industry.

Security analysts have cited the Bunni hack as another cautionary tale for both investors and developers, emphasizing the importance of robust code audits, time-locked contracts, and stronger liquidity management mechanisms to prevent similar exploits.

Bunni’s shutdown marks the end of a once-promising DEX project known for its innovative liquidity management tools and integration with other Ethereum-based protocols.