Dr Kemi Ogunyemi, the Special Adviser to the Lagos State Governor on Health, speaks to VICTORIA EDEME on the cholera outbreak in the state.

What are the primary causes of the recent cholera outbreak in Lagos State?

There have always been cases of cholera in Nigeria. We typically have isolated cases that we treat. However, we observed a surge in cholera cases between the 10th and 11th of June 2024. This increase qualifies it as an outbreak. The top three affected local government areas are Lagos Island, Kosofe, and Eti-Osa. The Nigeria Centre for Disease Control and Prevention anticipates cholera outbreaks, particularly during the rainy season, as is the case now. Firstly, this doesn’t surprise us. Secondly, we know the necessary steps to take when such outbreaks occur. It largely relates to environmental conditions and what I refer to as the social determinants of health. There are areas lacking adequate clean water, relying instead on wells. Open defecation is also prevalent. When it rains, these factors result in faecal matter contaminating water sources like wells. Other contributing factors include flooding when canals overflow and poor sanitation practices. What we observed was a sudden increase followed by a decline due to our prevention campaigns and efforts to raise awareness, encouraging regular handwashing. So, that’s the crux of the matter.

What specific factors contributed to the increased prevalence of cholera in those particular areas and regions you mentioned?

When there’s an outbreak like this, we have Environmental Health Services officials from the Ministry of Health and the Ministry of Environment who go around ensuring that the environment is kept clean. So when we noticed an increase in cases in Eti-Osa Local Government Area of Lagos specifically, we went there to investigate. We carried out a survey and found that the common denominator, which was one of the deadly factors, was a tiger nut drink. People who came to the hospitals all identified that they had drunk tiger nut drink. We couldn’t just take their word for it, so we had to take that drink and test it to see what was in it. We immediately sent people out to look for those selling it so we could take a sample. We found empty bottles with a name on them, but we discovered that it wasn’t even registered with the National Agency for Food and Drug Administration and Control, the regulatory body that ensures the safety of consumables. There was a phone number and a name on the bottle, and we started tracing. We did contact tracing, similar to what we did with COVID-19. We combed the area to ask people where they got the drinks from. We couldn’t find any full bottles. We only found empty ones, which were of no use because we could not test them. The phone number on the bottle was not reachable. From our investigations, we realised that the beverages were not registered, so the producers hadn’t gone through the processes to ensure that what they were producing was safe for the public to consume. We traced it to that. Of course, cholera is also water-borne, so we took samples of the water to test it. The bottom line is that we took stool samples because different things cause diarrhoea. It could be anything else. We found out that it was confirmed cholera, specifically Vibrio cholera subtype 01, which is the most infectious and aggressive type. There are different types, but we identified this one. In Lagos Island, Eti-osa, and Kosofe, we recorded the highest number of cases that went to the hospital. I’m not talking about reported cases. These are the people who did the right thing by going to the hospital to complain of symptoms, and they were treated. That’s when we were alerted. When the hospitals report cases, we are notified, and we set up an emergency office in Yaba to swing into action. That’s what we’ve been doing since. We continue to test everyone’s stool specimens. Unfortunately, we can’t test everyone because most have already taken antibiotics, which doesn’t give us a good sample. We test those who just came and have not taken anything at home. Hence, part of our campaign is to advise people not to take antibiotics. Pharmacists should not sell them antibiotics. They should come straight to the hospital for testing. We provide oral rehydration therapy, which is crucial during cholera symptoms. It doesn’t mean the other local governments didn’t have cases, they did, but the numbers started decreasing. We were quite relieved because there was a day when we didn’t have any new cases. However, we anticipated an increase after the Ileyah celebrations, which indeed happened. Unfortunately, we also had an increase in deaths. That’s the unfortunate part. More people have died, and about three of them were already dead upon arrival from home. From our history, we realised they had diarrhoea and vomiting for the past two or three days, but they never came to the hospital. They were probably treating themselves locally, which we advise against. That’s how we know. We’re hoping for a decline as we continue our efforts in the community.

The earlier data before the festivities recorded 15 fatalities. What is the case now?

It has increased. As of Thursday morning, we had 21 cases. During an emergency meeting around 11 pm on Wednesday, we received information that someone had died within an hour or two of arriving at the hospital from home. This individual did not just develop diarrhoea on that day but had been at home. The incident could have occurred before Ileyah or around that time, but we are reporting the death now because it happened recently. It’s not a new case that occurred on Wednesday; it’s a new case that has been reported, unfortunately resulting in death.

Aside from diarrhoea and vomiting, what other cholera symptoms should residents know?

It begins with abdominal pain. That’s the initial symptom. Following that, there is diarrhoea. Some cases may also present with fever, though not all. Additional symptoms include vomiting, muscle pains, and cramps, primarily due to the loss of electrolytes. Others include a rapid heart rate and general malaise. Fatigue and tiredness are also common due to the significant loss of water, which carries essential electrolytes like potassium, vitamins, and magnesium. These losses lead to muscle pain and cramps. While watery diarrhoea is the most typical symptom, not all instances of diarrhoea indicate cholera. Some people experience diarrhoea that resolves, but true cholera manifests as profuse watery diarrhoea, almost like water itself, as the bacteria in the small intestine absorb water from the body, causing it to pass quickly through the intestines.

How quickly do these symptoms typically appear after infection, and how is cholera diagnosed?

It varies depending on the amount of bacteria in the body. Symptoms can start within a few hours if the bacteria are already present in your system after consuming contaminated food or water. The onset also varies among individuals, similar to COVID-19 where the virus multiplies differently in different people. Some may experience symptoms within two to five days, but with cholera, symptoms can manifest in as little as 24 hours. Once symptoms appear, it’s crucial to seek medical attention immediately. During outbreaks like the current one, we typically suspect cholera based on symptoms, but confirmation requires a stool specimen. The Nigeria Centre for Disease Control and Prevention has distributed rapid diagnostic tests to all hospitals, enabling immediate testing on-site. Samples are also sent to labs for confirmatory tests.

Upon arrival at the hospital, anyone presenting with diarrhoea or vomiting receives immediate intravenous infusion for rehydration, regardless of test results. Hydration is prioritised to replace lost fluids and electrolytes, crucial for kidney function and overall health. Some patients arriving late required dialysis to manage dehydration-related complications. For those unable to reach a hospital promptly, we recommend oral rehydration with boiled, clean water, a pinch of salt, and a teaspoon of sugar mixed thoroughly. This temporary measure helps maintain electrolyte balance until professional medical care is accessed, ensuring their well-being until they receive proper treatment at a hospital.

In the areas affected in Lagos, how significantly has this outbreak impacted their health and daily lives?

Due to the sensitisation and campaigns, we’re conducting in all those communities, people know they have to be careful because of the outbreak. We revisited the Eti-osa area and did not find a single person selling tiger nut drinks. So the communities are devoid of all those beverages right now. People are aware, and that’s our goal. We want that awareness so that people are careful. We hope people are boiling their water, ensuring they’re washing their hands, and also taking responsibility by informing others not to defecate outside in the streets. Sadly, people continue these practices in their daily lives. Lagosians are very resilient, and we believe this has spread to other states. We know of a case where someone travelled from Lagos to Oyo State and then started showing symptoms, resulting in cases in Oyo State. So the NCDC is monitoring the situation across Nigeria, not just in Lagos State. Lagos State is typically where things originate due to our overpopulation and clustering of people. Many people have travelled to Lagos for festivities and returned to their states, contributing to the spread. It has also been reported in other states, with Bayelsa being the first after Lagos. Therefore, the NCDC is working diligently, providing support for Lagos and all other states.

The NCDC has stated that it may declare an emergency on cholera. What are the implications of this?

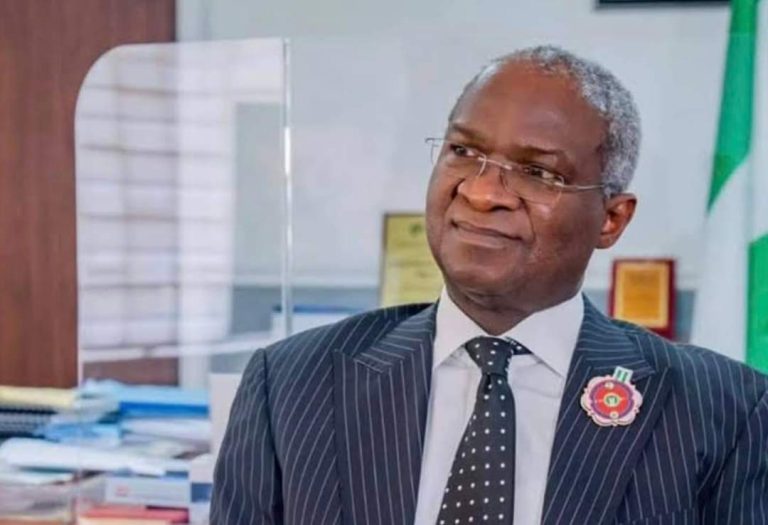

An emergency has not yet been declared. The NCDC is monitoring the trends and conducting risk assessments. We are actively involved in this effort. Dr Jide Idriss is the DG of NCDC, and his team members are in Lagos. We are collaborating closely with them, as well as with the Ministry of Environment and the Ministry of Education, particularly concerning children. We are working diligently to ensure that the spread is contained. Risk assessments are ongoing, and further action will depend on whether the NCDC decides to declare an emergency. Hopefully, this will not be necessary as we aim to avoid causing panic. People are going about their daily lives; everyone is going to work, and schools remain open. If an emergency were declared, schools would have been closed. There are established protocols in place. Within the Ministry of Education, we have a quality assurance system that monitors developments and keeps us informed. There have been no reports of schoolchildren vomiting in schools. Teachers have been sensitised and instructed on what symptoms to look for and what actions to take. Hydration measures are also in place in schools. We are actively managing the situation. This is typical in outbreaks; cholera is not new in Nigeria. It’s during outbreaks that the NCDC is particularly vigilant, and we implement these measures.

Is there any collaboration with national or international health organisations in managing this crisis? If so, can you elaborate on these partnerships?

Many people have been mobilised, and we’re working with numerous partners. UNICEF has been fantastic. They excel in providing information. The Red Cross has also been extremely helpful. Additionally, WHO consistently monitors the situation to prevent it from escalating into a pandemic, although we are confident it won’t. We are currently in a monitoring phase. As I mentioned earlier, we anticipated a potential increase following the Ileyah Festival when everyone returns home and settles down, and that’s indeed what we’ve observed. Therefore, we are closely monitoring the situation day by day. We convene every night to discuss developments, where people provide their reports based on the pillars we are focusing on. We analyse electronic real-time data, conduct risk assessments, and oversee community surveillance, among other aspects. Currently, the situation is not deemed an emergency, and we are urging people not to panic. Treatment for suspected cholera cases at hospitals is entirely free of charge. We understand that some individuals may be concerned about medical expenses, but they need not worry as it is a public health concern. Treatment, including diagnosis, medications, and admission, is provided free of charge at all public government-owned hospitals and primary healthcare centres. No one will be asked for payment. While hospitalisation may not be necessary for everyone, we understand the economic challenges people face, which may deter them from seeking medical care.