Narrative does change; as life goes on, the beauty of who you are will be defined by your intentions toward yourself, your fans, and your craft. Kiddwaya is a major player in Entertainment industry, and he is using his influence and individuality to improve the relationships of the fans and Stan.

How Kiddwaya moved away from other people’s realities to pursue his own reality without taking away his wholesome personality needs to be adequately studied. Kiddwaya channeled his intuition into a dream life and the goals he has always desired at a time when so many people believed in life on social media and were faking impressions just to keep up with the gram. He took the importance of social media and celebrities’ lifestyles to a different level, thereby steadily building his fortress and creating a diversified niche.

The reality of a favorite can also influence the stans, which explains the WDG’s extraordinary composure and positivity adoration. a base that took time not just to keep up with their favorite alone but also took a cue from his positive and global impact. Boldness and a proper understanding of life are their forte—class beyond class, you might say.

Due to Kidd Waya’s significant actions over the course of his three years of fame, this special edition of Ranks Africa Magazine is dedicated to him.

So now it’s over to you. What do you think of this issue, both in print and online? What do you like and what is missing? Let us know RanksAfrica@gmail.com or @RanksAfrica on Twitter and Instagram and we’ll see what we can deliver in our forthcoming issues.

READ FULL DIGITAL COPY HERE

The influence of Kunle Afolayan is long-lasting and profound. Prior to the monumental success of ANIKULAPO, Kunle Afolayan has always worked with magic, both historically and currently. He served as an inspiration for many filmmakers even before cinema and online streaming were widely adopted in Nigeria; to his credit, movies like Irapada, The Figurine, Phone Swap, October 1, Roti, The CEO, Mokalik, etc. have all been named the finest movies by movie lovers.

Without a doubt, Kunle Afolayan revolutionized how viewers rated Nigerian films. He is one of the most well-known directors to emerge in the last two decades. He also fits the description of a director who is aware of the idea of talent stardom.

Even though Kunle Afolayan has not yet received an Oscar, he will always be considered one of the best in the world. For this reason, a special edition of Ranks Africa Magazine has been created to recognize and commemorate him.

With nearly three decades of professional acting experience, Kunle Afolayan is not just a talented filmmaker but also a very skilled actor who is pleasant, charming, and easygoing.

We also name 14 actors in this special issue of the magazine who you should watch out for in 2023. The list includes actors who are having breakout years, stars of highly anticipated films for the awards season, and even actors who are making their film debuts.

So now it’s over to you. What do you think of this issue, both in print and online? What do you like and what is missing? Let us know RanksAfrica@gmail.com or @RanksAfrica on Twitter and Instagram and we’ll see what we can deliver in our forthcoming issues.

DOWNLOAD THE DIGITAL COPY HERE

In Nigeria, becoming a successful entrepreneur and influencer is not simple, especially for well-known individuals. There is pressure attached. Hard work, expertise, and frequently a small bit of luck is necessary.

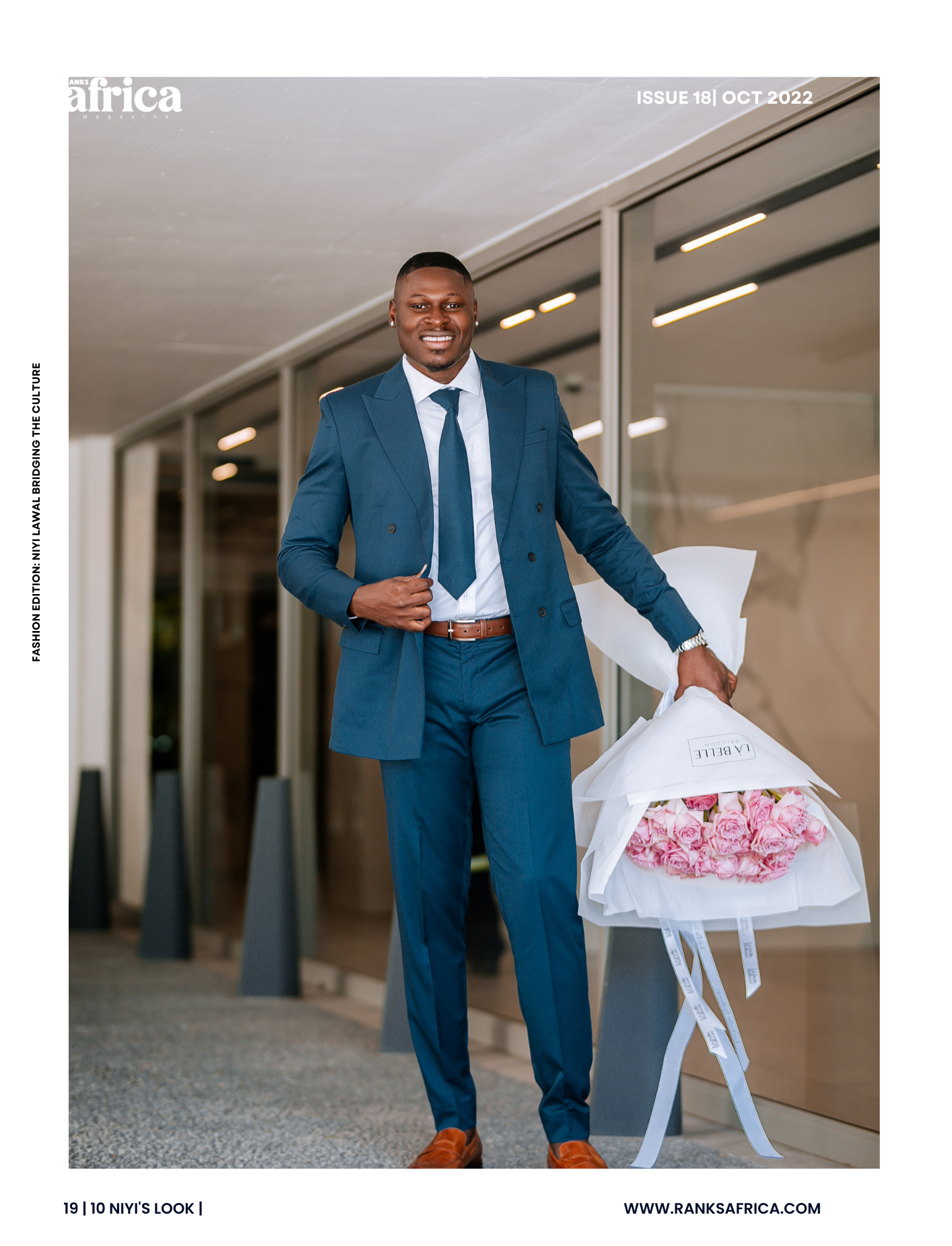

One of the few people who had a successful business before becoming famous is Niyi. Since Niyi Lawal was presented to the world via the reality television show “Big Brother Naija” season 6’s “Shine Ya Eye,” many have come to the conclusion that you don’t need to be an entertainer before you join the show.

Due to the way he conducts himself on the show, Niyi continues to be one of the most respected #BBNAIJA naija alumni.

We at Ranks Africa have decided to celebrate those who have achieved professional success and used their enterprises to have a positive influence on their industry as well as society at large. This is the driving force behind this magazine.

This time around, Niyi Lawal, a successful serial entrepreneur and fashion influencer, is the subject of our focus story. You’ll find this quite interesting.

THE PRINT COPY IS GOING TO BE AVAILABLE FROM 30TH OCT. 2022

You can order by sending Email Ranksafrica@gmail.com or DM @ranksafrica on instagram

You can DOWNLOAD DIGITAL HERE FOR FREE

Ranks Magazine is a media outlet documenting creative minds today for tomorrow, which Identify and Promote Business, People and Industries from the perspective of every people & connecting people to latest business news

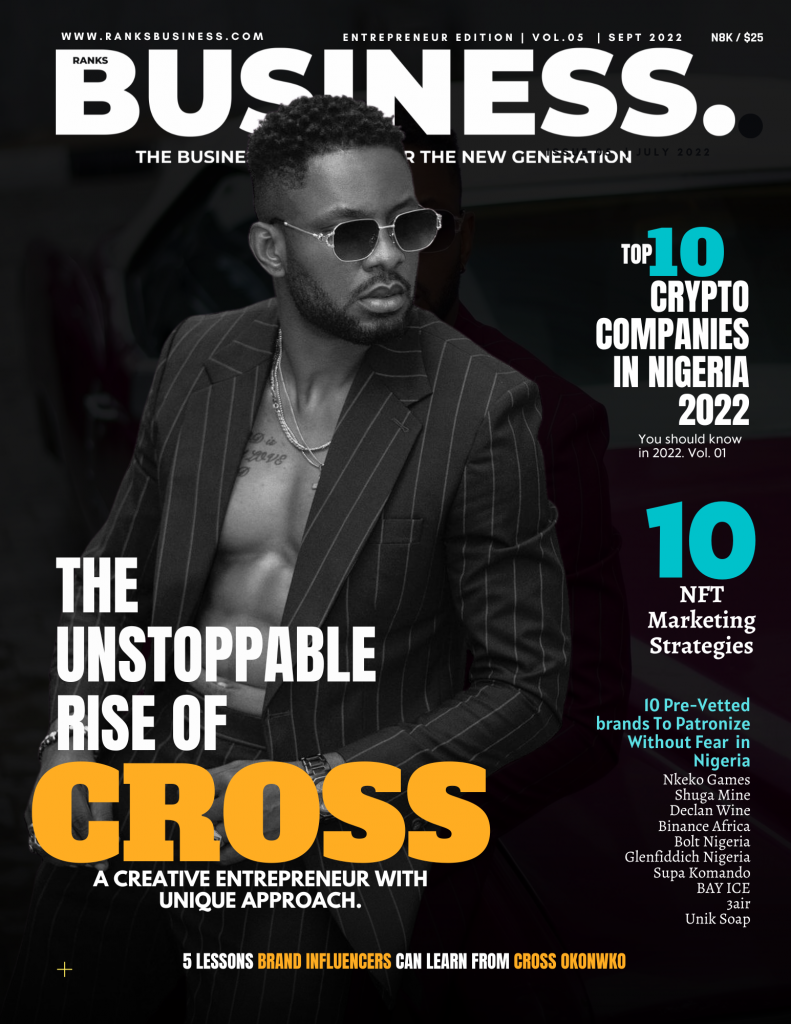

Two things happen when you live through an era of rapid change, as we are now. Firstly, there is an inevitable surge of artistic creativity and second the contrarians, the non-conformists and the anti-heroes come into their own. We witness the rise of the rebel: those who don’t play by the normal rules, who flourish in chaotic, unpredictable times and welcome uncertainty without fear. This is what this edition of Ranks Africa Magazine, celebrating Entrepreneur, Cross Okonkwo is all about. This edition celebrates the curious revolutionaries who think differently and this is reflected in the articles and contents carefully put together in this edition.

This edition, gives an insight into the life and brand of Ikechukwu Sunday Cross Okonkwo, popularly known as Cross, Entertainer, Lifestyle & Fitness Entrepreneur and the King of the Cross Nation.

The Hardcopy is 8,000 and 2,000 for digital copy

PAY TO Worldlink ICT Services 1014791447, zenith bank

Send Payment Slip +2348137586216 or +2348087571401 for Confirmation

LIMITED EDITION AVAILABLE

Taking a giant step from certainty to uncertainty, Cross da Boss inspires entrepreneurs, setting a new standard beyond entertainment on this exclusive edition of Ranks Magazine which explores his entrepreneurship journey, growth and lifestyle.

To all members of the CROSS NATION across the globe, this is a must have ‘master piece’ of your king and serial Entrepreneur available.

I am actually not in the mood to write but i must make my comments quickly before the rush begins and everyone becomes a film authority; strike while the iron is hot yes? Ok so let’s go!

Bolanle Austen Peters’ HOUSE OF GA’A actually turned out to be nothing i expected really because the trailer did not do enough justice to the film itself. When i saw the trailer and the leather skin war clothes which the warriors were costumed in (which i still don’t agree with), i did a quick mental write-off of the film as just another of those attempts at telling historical stories so imagine my surprise when it turned out not to be, at least according to my opinion.

‘Boo l’aya o sika, boo ranti iku Ga’a, o sooto’ is a popular proverb among the Yoruba people and the fil House of Ga’a did well in the graphic illustration of that trepidation this statement is intended to cause as a deterring statement for wickedness so I say that this one came thematically correct although there were certain narratives in the plot line that took a slightly different turn and deviated from the story we know especially from Adebayo Faleti’s version which is the most popular one until now. I have however learnt not to enter story disputes because story narratives depends on the paradigm of who told you the tale and the extent of knowledge available to the person or the amount of information recoverable from memory recall and/or empirical data available so in effect, stories on same subjects will continue to differ till the end of time as long as there are perspectives and sentiments therefore, it is alright to hold on to your own belief and allow the other person to hold on to his or hers.

Now, let’s talk about the Jagun Femi Branch in the title character of Bashorun Ga’a; i want to scream wow! Wow! Wow! Femi Branch deserves another chieftaincy title for this performance and I forsee many scripts in his mail after this which means plenty money in his account so uncle Femi, for hearing dey o. i particularly liked the Bashorun Ga’a’s private mourning scene after her lost one his sons and one other wounded in a staged fight; it was intense and showed Femi Branch’s acting dexterity and range, i felt like stretching my hand into the screen and tell him sorry just like my almost two year old daughter, Omokorewa will tell me “Dada, sooorry” with a very somber face when she perceives i am in one kind of pain or the other. He was the role and the role was him plus his carriage was out of this world although I found the shouting in the in-chamber scene with the Zainab character a tad bit unnecessary and over the cliff. I felt he could have sent her out more calmly which would have suited the Ga’a character more as he wasn’t an impulsive talker but extremely strategic with a large capacity for patience till it’s the right time for revenge as he displayed with Alaafin Labisi but on the whole, Femi Branch nailed it, killed it and brought it home. It was refreshing to see Funke Akindele in a character that didn’t look anything like the Jennifer or SHE character because from where i stand, i conclude that her big screen career has been dotted by characters who look and sound alike. Now before you disagree, do a mental flip through her roles. Niyi Johnson also blew my heart away with his performance as Alaafin Abiodun and he gladdened my heart with his performance.

As usual, the director took some liberties with the indices of production design especially with costumes and architecture, since I wasn’t born then anyway, i cannot argue how correct or incorrect these designs are but in the general context of the picture look and feel, the entire concept came together nicely and made for a pleasant watch from top to bottom so the discussions on whatever liberties Bolanle Austen Peters took with these components is not necessary for me because they all locked into the film flow and final material.

The picture has a rustic colour grade look and feel but it gives off as intentional so there’s not much colours but what it lacks in colours, it compensates for in spectacle; the spectacle in this film gladdens my heart. The entire film was rich from beginning till end with the whole total theatre flow of music, dance, chants, acrobatics and magic – a total African performance potpourri.

One factor I liked very much was the Producer and director recognizing that this kind of film was not her strength thus her decision to reach out to Femi Adebayo and Ibrahim Chatta are Consulting Producers; this is a good move that every producer especially Yoruba film genre producers should learn from; do not jump into something that is not your area of strengths without seeking help and have the good sense to enter collaborations to cover your weaknesses, it is not a sin. In any case, the HOUSE OF GA’A is one spectacle of gladness which is worth the watch if you excuse the little slips here and there.

PS: I might come back to say more!

Credit: Tolu Fagbure

Wike fixes August 1 to honour Abuja traditional rulers, warns would-be protesters

FCT minister Nyesom Wike says Abuja will not be available for protesters on August 1.

Mr Wike gave the warning while briefing newsmen on the outcome of the FCT security council meeting in Abuja on Thursday.

He said that August 1 had been set aside for the chairpersons of the six area councils of Abuja to give out certificates of recognition to their traditional rulers.

“That is the day FCT has set aside for the entire area councils to jubilate, to give out certificates of recognition for their traditional rulers. We will not allow that day that FCT has set aside to honour their traditional rulers for their people to rejoice, and then somebody will come and disrupt that day. We will not allow it.

“We want people to come out and celebrate, as part of the achievement of the current administration. That day is not available for those who want to protest and FCT is not available for the protesters,” the FCT minister said.

Mr Wike said the security council was aware of the threat of the protest and what some people may call the “end bad governance.”

Noting the right of people to protest or demonstrate, the minister said that such rights must be done within the ambit of the law.

“This period, we think that all Nigerians should work collectively to salvage our country. I am aware that there are challenges, but President Bola Tinubu and his team are working right now to ensure that these challenges facing our country are addressed.

“We know that it is a very difficult period for citizens; Tinubu has come out clearly to say that there are challenges; there are problems, but these challenges and problems will be tackled,” Mr Wike said.

The minister, who expressed confidence in Mr Tinubu’s capacity to address the challenge, urged all Nigerians to be patient.

“For instance, in FCT, we have seen the changes. We have seen that the government is working. Tinubu is giving FCT so much support that all of us can attest to the fact that there are a lot of changes going on in FCT.

“Therefore, we will not allow anybody to set us back. We are looking forward to making sure that we take FCT to where it is supposed to be as one of the major cities, not only in Africa but in the world.

“So, we will not allow anybody to disrupt peace and set us back. For those who want to protest on August 1, or thereabout, FCT is not available for such protest,” Mr Wike said.

(NAN)

”In a bold and unwavering statement, the President of Nigeria, Bola Tinubu, has asserted that his administration is free from the control and influence of any cabal. He emphasized that the financial resources used during his election campaign were entirely his personal fortune, underscoring his independence and commitment to the nation’s welfare.

During a meeting with a delegation of Islamic leaders led by Sheikh Bala Lau at the State House in Abuja, President Tinubu revealed the challenges he faced during his campaign. He recounted how the closure of banks during the period created significant obstacles, yet he emerged victorious. “I have no cabal. I have no sponsors. The money I spent on the elections was my personal fortune. At some point, the odds were against me; banks were locked. But Allah, the Almighty God, said I will be the President,” Tinubu declared.

President Tinubu emphasized that a good conscience is one of the most potent defenses against corruption. He highlighted the importance of teaching future generations the values of good citizenship and responsibility. “What should be uppermost in our minds is the future of our children. We have a lot to teach them on what it takes to be a good citizen and what it takes to be a responsible citizen,” he stated.

In light of a planned nationwide protest by certain groups, President Tinubu urged the organizers to reconsider their stance. He cautioned that protests fueled by anger and hate could escalate into violence and set the country back. He reaffirmed his administration’s commitment to meeting the needs of Nigerians and reassured citizens that steps are being taken to improve social welfare and economic support.

President Tinubu outlined several initiatives aimed at alleviating the hardships faced by Nigerians:

Reworking the Social Welfare Scheme: Efforts are being made to ensure that social welfare reaches the ward level, the closest level to the people, to support the poor and vulnerable.

Student Loans: The government will provide loans to cover school fees, ensuring access to education for all children.

Consumer Credit: Financial support will be available for citizens to buy cars and houses, with the option to repay gradually.

Increased Minimum Wage: The minimum wage has been increased by more than 100 percent to help ease the financial burden on workers.

President Tinubu did not hold back in his criticism of the sponsors of the planned protest. He accused them of prioritizing their selfish ambitions over national interest and of having alternative passports and virtual meetings from different parts of the world. “The sponsors of protests do not love our country. They have no love for the nation. They do not understand citizenship.

The President cautioned against premature politics driven by hate and anger, drawing comparisons to the situation in Sudan. “We do not want to turn Nigeria into Sudan. We are talking about hunger, not burials. We have to be careful. We should be careful with premature politics; politics of hate, and anger,” he warned.

In his remarks, Sheikh Bala Lau, the leader of the delegation, assured President Tinubu of their support through prayers and increased sensitization efforts. The clerics pledged to stand by the President in his quest to lead Nigeria towards a brighter future.

The Nigerian startup selected to build the country’s first AI, Awarri, has engaged over 500 fellows of the federal government’s 3 Million Technical Talent program as data collectors in building the Large Language Multilingual Model.

The Minister of Communications, Innovation, and Digital Economy, Dr. Bosun Tijani, disclosed this on Wednesday, reiterating the government’s commitment to creating more jobs for Nigerians in the tech space.

“I’m glad to see the growth of the Awarri team since its launch in November 2023 to 120 staff, with an additional engagement of over 500 fellows from our 3MTTNigeria programme as data collectors, as they build Nigeria’s first Large Language Multilingual Model.

“Looking forward to seeing more companies in the space as we slowly but surely build a technology workforce that will contribute to global AI development,” the Minister stated in a post on X Wednesday night.

According to the Minister, Awarri kicked off operations with 100 AI jobs in Ikorodu in November last year. He described the startup as a full-stack offering that ranges from data gathering to model creation and AI application development.

Nigeria’s AI Model

Tijani at the end of a 4-day AI workshop held in Abuja in April announced the launch of Nigeria’s first Multilingual Large Language Model (LLM).

According to him, the AI tool was launched through a partnership between a Nigerian AI company, Awarritech, a global tech company, DataDotOrg, the National Information Technology Development Agency (NITDA), and the National Centre for AI and Robotics (NCAIR).

“The LLM will be trained in 5 low resource languages and accented English to ensure stronger language representation in existing datasets for the development of Artificial Intelligence solutions. The project will also be supported by over 7,000 fellows from the 3MTT Nigeria program,” the Minister stated.

What you should know

As part of the ongoing technical skills training, the government has also promised to facilitate jobs for the 3MTT fellows in line with President Tinubu’s promise of creating a million tech jobs within the first two years of his administration.

While announcing the selection of fellows for the second cohort of the program recently, the Communications Minister disclosed that a significant number of fellows in the first cohort of the program were being placed into jobs as interns all over the country.

According to Tijani, the 3MTT program is a critical part of the Renewed Hope agenda, and is aimed at building Nigeria’s technical talent backbone to power its digital economy and position Nigeria as a net talent exporter.

The program started with 30,000 Nigerians, representing 1% of the 3 million target, while the 270,000 selected for the second cohort brings the number to 10%. To achieve the program’s target,

Tijani said the different phases will be executed based on the framework co-created with key stakeholders across government agencies, training providers, educational institutions, development agencies, and the private sector.

A US Bank that operates accounts for startups globally, Mercury, has notified Nigerian startup founders who have accounts with it of plans to close their accounts on August 22, 2024.

According to the Bank, Nigeria has been listed as one of the prohibited countries by its partners, hence, it would not be able to continue to operate an account for Nigerian startups and others from the prohibited countries.

The list of the prohibited countries published by the Bank on its website shows 37 countries mainly from Africa and the Middle East.

Aside from Nigeria, other African countries blacklisted by the Bank include Burundi, Cameroon, the Central Africa Republic, the Democratic Republic of Congo, Mali, Mozambique, Sudan, and Zimbabwe.

No further explanation

Aside from a short message on its website stating that international founders “in countries prohibited by our banking partners” are not eligible to open an account with it anymore, Mercury did not provide further explanations on why the countries have been prohibited.

A co-founder of Nigerian edtech startup, Altschool Africa, Akintunde Sultan, whose company is affected by the closure lamented that the Bank gave no clear explanation of its action.

“Mercury closed my accounts too even with founders living in the US. No proper process or appeal, just carry your money and go if you have ties to Nigeria. The exact policy that caused this isn’t even well explained, because comparing Nigeria to Afghanistan is funny. I guess we’re all moving our accounts to a new USD business account now,” he shared in a post on X.

The email from the Bank to the startup founder simply read:

“We regret to inform you that due to recent changes in how we determine account eligibility, we are no longer able to support accounts for businesses with associated addresses located in these countries (the prohibited countries). As a result, we will be closing the Mercury account for AltSchool Africa Inc. on August 22, 2024.”

What you should know

Many African startups are incorporated in the US to have easy access to funding. Financial institutions such as Mercury make it possible for them to open a US bank account even without actually being in the US.

Industry analysts have also noted that for any African startup that has received capital from US investors, it is easier for them to keep the capital in dollars in the US and only bring what the need for their operational needs to their home country.

This also makes it easier for them to pay any of their foreign workers directly from the US.

Until its collapse last year, Silicon Valley Bank (SVB) was the main bank for many African startups. SVB’s collapse saw many of them move to other alternatives including Mercury.