In line with its commitment to food security and sufficiency in Lagos, Governor Babajide Sanwo-Olu’s administration has established concrete plans for effective collaboration between Rungis International Market, renowned as the world’s second-largest wholesale food market, and the Lagos State Government.

Governor Sanwo-Olu disclosed the collaboration during the visit of some Lagos State Government officials to the Rungis International Market in Paris, France, on Thursday.

Sanwo-Olu, who was accompanied by Lagos State Commissioner for Agriculture, Ms. Abisola Olusanya; Special Adviser to Governor on Agriculture, Dr. Omotola Fashola; and Executive Assistant to Governor on Agriculture, Mr. Olaniwun Gbolabo Owolabi, said the aim of the visit was to establish strategic and technical partnerships essential for the development and operationalisation of the Lagos Food and Logistics Hub.

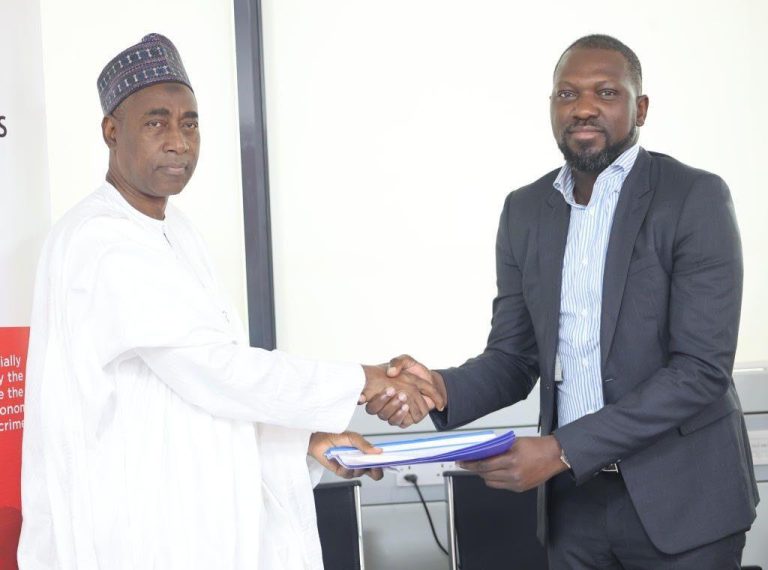

The Governor had robust discussions with some key individuals, which included the Chairman and Executive Officer of Semmaris, Stephane Layani; Director of the International Business Unit, Bertrand Ambrouse; Head of International Projects at Semmaris-Rungis Market, Timothée Witkowski; and Chairman of Origin Group, Prince S.J. Samuel.

Speaking about the visit, Governor Sanwo-Olu said: “I had the opportunity to explore the vibrant Rungis International Market in Paris. I was inspired to discover that this market is not just the second-largest wholesale food market in the world but also covers an impressive 232 hectares of land.

“This visit puts into motion the beginning of a meaningful strategic and technical partnership for the development and operationalisation of our Lagos Food and Logistics Hub project.

“I met with the management team of Rungis International Wholesale Food Market in Paris, France. Our discussions centred around the crucial role markets play in addressing the complexities of modern food systems, as well as exploring potential collaborations for the Lagos Food and Logistics Hub project.

“During the meeting, we were able to establish concrete plans for effective collaboration between Rungis International Market, renowned as the world’s second largest wholesale food market, and the Lagos State Government.”

Governor Sanwo-Olu and his team’s visit to Rungis International Market in Paris is part of efforts being put in place by the Lagos State Government to advance the construction of sub-Saharan Africa’s largest Food Security System and General Logistics Park on a 1.2 million-square metre site in Ketu-Ereyun, Epe.

It would be recalled that Governor Sanwo-Olu, on August 24, 2022, flagged off the construction of the Lagos Food and Logistics Hub project, which will be the largest Food Security Systems and Central Logistics Park in sub-Saharan Africa when completed. He performed the sod turning of the project at the site of the facility being built on 1.2 million square metres of land in Ketu-Ereyun, Epe.

The establishment of the food park is a component of an audacious five-year Agricultural and Food Systems Road Map (2021–2025) launched in 2021 by the Babajide Sanwo-Olu administration to enhance food sufficiency in Lagos.

When completed, the central food and logistics hub is expected to create direct wealth for more than five million traders in the agricultural value chain while guaranteeing uninterrupted food supplies to more than 10 million Lagosians for at least 90 days in a period of scarcity.

The hub will have storage facilities for more than 1,500 trucks that will daily service the needs of thousands of operators within the food value chain throughout the year, while large commercial transactions will be processed in the facility.

The central food hub would guarantee greater returns for farmers and investors in the agro-allied sector, as the facility would cut out several layers of middlemen and facilitate improved access to modern processing and packaging services. The market matrix generated from the facility would help the government generate useful data for public planning and for the use of private sector players to project investment.

#AGreaterLagosRising

#LASG