𝗛𝗢𝗪 𝗬𝗢𝗥𝗨𝗕𝗔 𝗣𝗘𝗢𝗣𝗟𝗘 & 𝗜𝗡𝗚𝗘𝗡𝗨𝗜𝗧𝗬 𝗖𝗥𝗘𝗔𝗧𝗘𝗗 𝗡𝗢𝗟𝗟𝗬𝗪𝗢𝗢𝗗.

The media is currently abuzz with a statement credited to Aisha Lawal which is that the Yoruba people Created and Pioneered the Nigerian movie industry popularly known as “Nollywood”. Is it true that the Yoruba people created Nollywood? Let’s take a look at what the facts say.

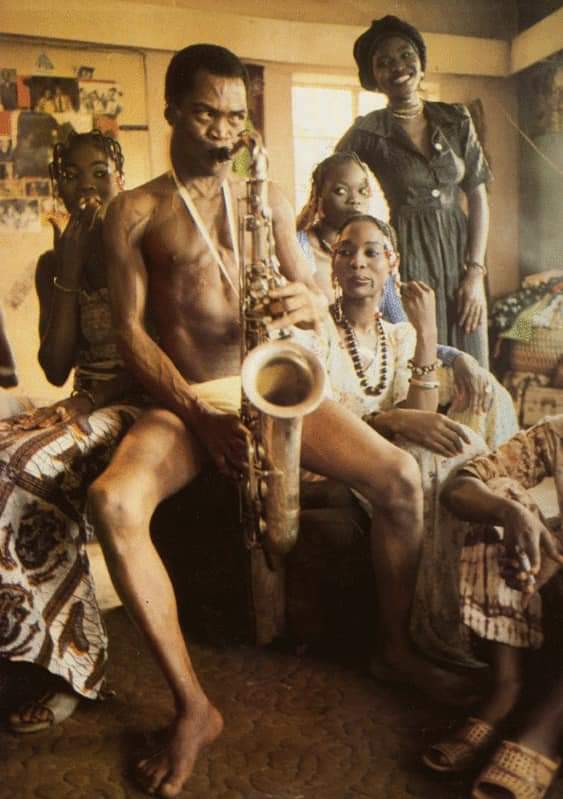

‘Nollywood’ as we know it today, wasn’t always called that. The Nigerian movie scene started with “The Golden age Era” which was the time period between 1950s to late 80s when theatre, stage plays and performance troupes that were mobile dominated the scene. According to the facts, productions from Western Nigeria were the major force propelling the acting industry in this time period. The earliest and most famous Nigerian thespians of then were largely Yoruba people including people like; Moses Olaiya, Jab Adu (Joseph Biodun Babajide), Isola Ogunsola, Ladi Ladebo, Sanya Dosumu and Hubert Ogunde who transitioned into the big screen. It is no mistake that Hubert Ògúndé is regarded as the father of theatre and performace arts in Nigeria.

Latola Films, which started the production of motion pictures since 1962, has often been noted as the earliest Nigerian indigenous film production company in Nigeria. Television broadcasting in Nigeria began in 1959 spear headed by the Western Nigeria Television (WNTV) Ibadan, which made it a point to broadcast the theatre and productions of the early pioneers into the homes of the denizens of Western Nigeria.

Before then a few films such as Kongi’s harvest by Francis Oladele, a film based on a work of the same name by Wole Soyinka was released in 1970s. Ola Balogun’s post-civil War film, Amadi (1975) was one of the first notable Nigerian historical films on celluloid. Balogun subsequently directed Ajani Ogun in 1976, a film which grew to become very popular, and is widely regarded as the first “commercial” Nigerian film, due to its success. This movie had Adeyemi Afolayan, father of current trailblazers Kunle Afolayan (producer of Anikulapo) as its main star.

Other popular films released in this era include: Bull Frog in the Sun (1974), Dinner with the Devil (1975); directed by the duo Sanya Dosunmu and Wole Amele, Ogunde’s Aiye (1979), Jaiyesimi (1980), Cry Freedom (1981). These were all before Achebe’s things fall apart was adapted to television in 1987.

Another very successful television adaptation was the adaptation of D.O. Fagunwa’s 1949’s novel, Igbo Olodumare. The television series of the same title witnessed a tremendous success, especially in South western states, where it was reported that the show constantly left streets deserted during its broadcast on Sunday evenings.

In terms of revenue generation, After several moderately successful films, productions like Papa Ajasco (1984) by Wale Adenuga became one of the first Nigerian mega grossers, reportedly grossing about ₦61,000 (₦88.64 million in 2023) in three days. A year later, Mosebolatan (1985) by Moses Olaiya also grossed ₦107,000 (₦183 million in today’s money) within five days and officially became Nigerias first Blockbuster.

Later on in the late 1980’s the Golden age began to come to an end due to many reasons but most importantly due to the in crease in the onership of private television sets at home.

The industry moved on to the production of home videos, an era which was termed “The video film era”. Again the Yoruba people led and pioneered the industry. Firstly, by 1984, television programming in the western region, which was the major area the cinemas served had improved tremendously and more television stations were established in the region as well, leading to a significant decline in cinema culture and embrace of private television viewing.

Jimi Odumosu’s Evil Encounter, a 1983 horror film released directly on television, was the first production to be a pointer to how lucrative making film directly on video can be. The film was extensively promoted before being aired on the television, and as a result, had streets flooded the following morning with video copies of the recorded broadcast. Since Evil Encounter, it became common in Nigerian cities to see video copies of recorded television programmes traded on the streets. This was the method that was adopted by producers and distributors from Eastern Nigeria who came into the movie scene later on, often with copyright violations and piracy issues but with major success in proliferation of views.

The first film produced directly on video in Nigeria is 1988’s Soso Meji, produced by Ade Ajiboye. Subsequently, Alade Aromire produced Ekun (1989) on video. These are the pioneers and fathers of Nigerian Home Videos or VHS. The era became entrenched in the 90’s with the proliferation of VHS video players in homes. This was the time when movie production from Eastern Nigeria became a major force in Nollywood. Kenneth Nnebue’s Living in Bondage (1992) was released in this era and many of the popular stars of igbo extraction made their names in this period too.

Now, the Nigerian movie industry or ‘Nollywood’ is moving to its newest and most modern phase. An Era that has been termed “New Nollywood”. New Nolywood is characterized by a major shift in the method of film production, from the video format/VCD discs, which came about during the video boom, back to the original cinema method the industry started out with, which constituted the films produced in the Golden Era of Nigerian cinema, and which also dominates in most countries around the globe with an organized movie industries.

This method is once again led by the Yoruba people. This is evident in the fact that the vast majority of the highest earning/grossing Nigerian movies of recent times have been largely dominated by producers of Southwestern origin like; Funke Akindele Niyi Akinmolayan, Kemi Adetiba, Kayode Kasum and others. Such movies as: Battle on Buka street to Omo ghetto, Wedding party, King of thieves, Ijakumo, King of boys Etc.

The second facet of this new era which has come with the proliferation of internet services of good quality is the- On demand streaming services and payTV sector which has seen Yoruba speaking movie productions like Anikulapo and Jagun Jagun reach record heights, becoming some of the most watched Non-English movies in the entire world on these Internet streaming platforms.

So… Yes, Aisha Oladunni Lawal is very much correct when she said Yorubas created Nollywood. And what she said is verifiable by both historical and empirical data. The only issue is some people who do not like hearing the truth and who enjoy obfuscating historical facts. Ire o.

Credit The Yoruba Nation CH on X.