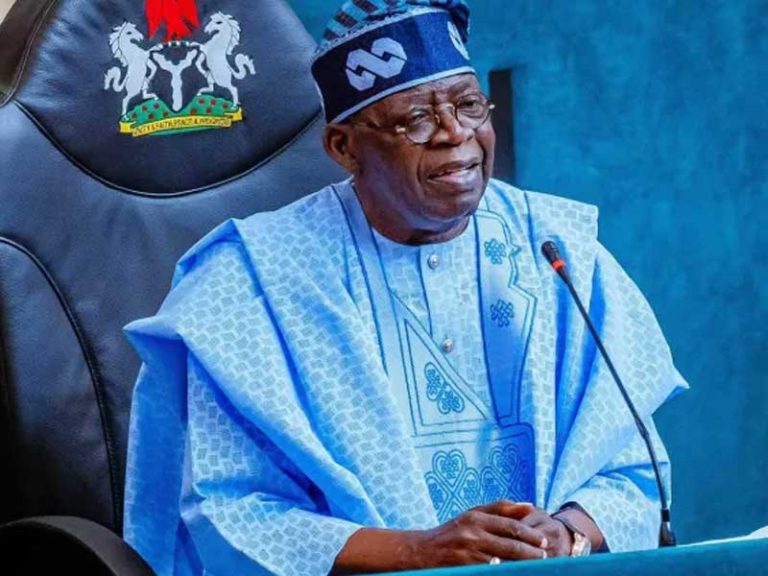

Lagos, Nigeria — Nigeria’s Minister of State for Petroleum Resources (Oil), Heineken Lokpobiri, has called for renewed global investment in oil and gas infrastructure, warning that the world must invest around $450 billion annually in the sector to prevent a potential energy crisis by 2050.

Speaking at the 9th OTL Africa Downstream Energy Week in Lagos, Lokpobiri said the need for sustained investment in hydrocarbons remains critical, even as nations push toward cleaner energy alternatives.

Citing revised projections from the International Energy Agency (IEA), he noted that the agency has shifted from its earlier stance on fossil fuels and now acknowledges the need for a balanced energy transition that aligns with rising global demand.

“The world population is expected to grow by another two billion people by 2050, and with that, energy demand will rise significantly,” Lokpobiri said. “Even with the best of renewable energy technologies, hydrocarbons will remain indispensable to global energy security.”

He emphasized that while global narratives continue to focus on decarbonization, developing regions — particularly Africa — must prioritize pragmatic energy strategies that reflect their developmental realities.

According to the minister, Africa’s challenge is not a lack of demand for energy, but its inability to capture value locally due to limited refining capacity, poor infrastructure, and weak distribution systems.

Lokpobiri reiterated Nigeria’s commitment to strengthening its oil and gas value chain through refinery rehabilitation, infrastructure upgrades, and private sector partnerships aimed at ensuring energy affordability and sustainability.

Industry observers at the conference agreed that while renewables will play an expanding role, hydrocarbons will continue to anchor global energy stability well into the mid-century.

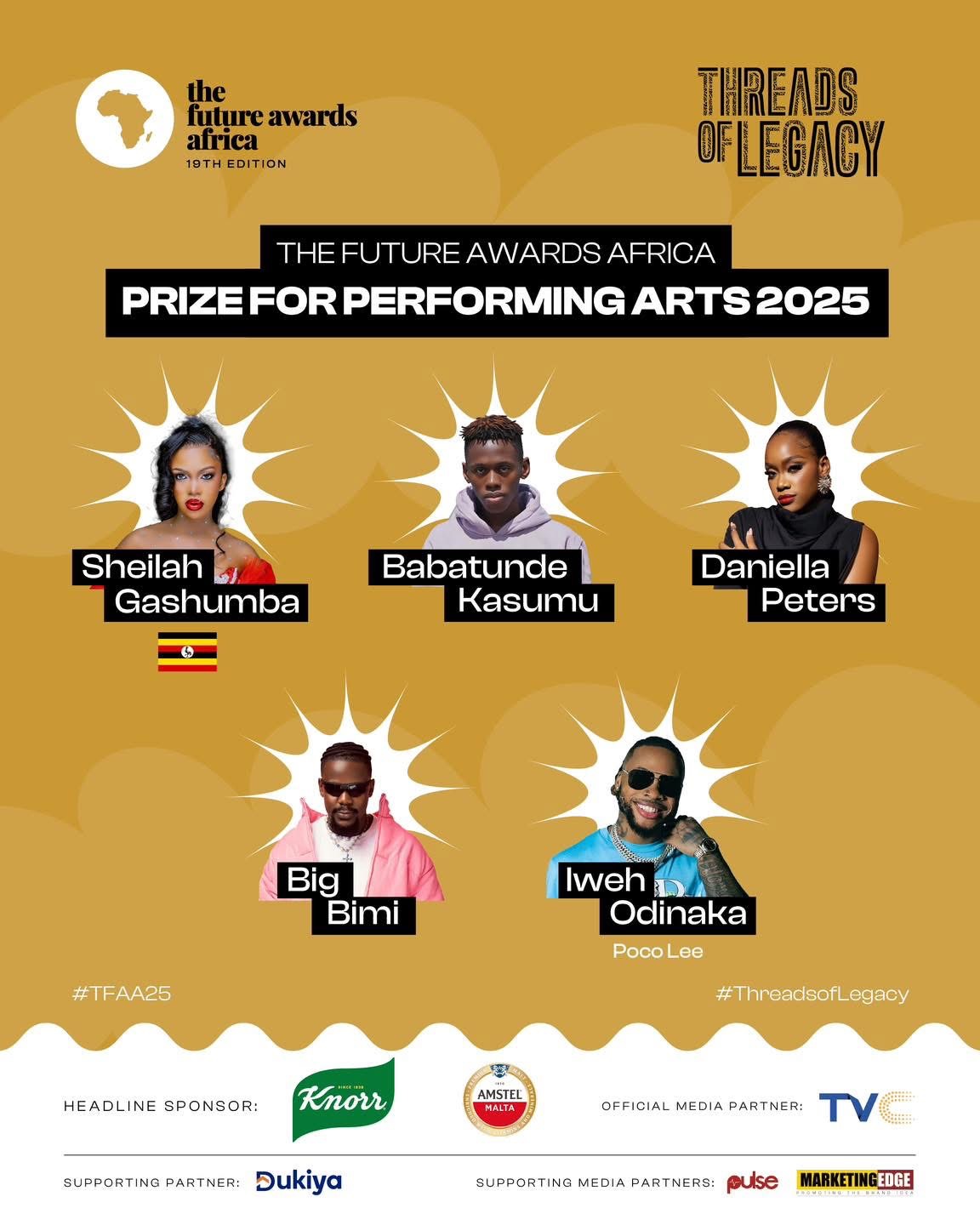

(Nigeria) — An artist whose music resonates with authenticity and modern African rhythm, Big Bimi continues to bridge the gap between culture and contemporary sound.

(Nigeria) — An artist whose music resonates with authenticity and modern African rhythm, Big Bimi continues to bridge the gap between culture and contemporary sound.