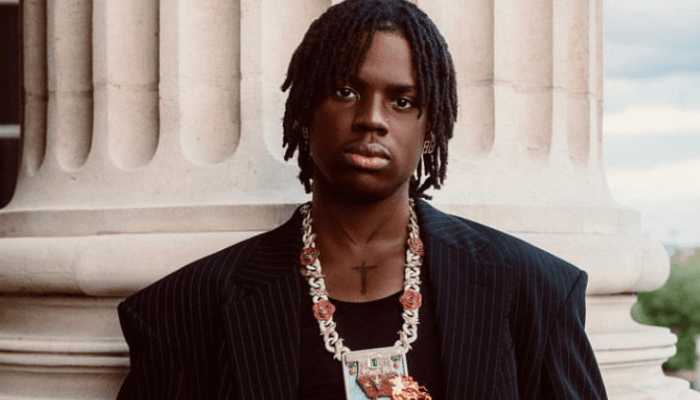

Rema’s sophomore album, HEIS, dropped on July 11th, 2024, and it has divided Afrobeats fans because of its experimental sound adoption.

HEIS, an 11-track album, breaks the mould from how it was released. The album was released on a Thursday, breaking away from the typical ‘New Music Friday’ – a recently adopted culture of music artists releasing their projects on Fridays.

This showcased Rema’s desire to push boundaries and explore uncharted sonic territories. The album’s lead single, ‘Hehehe,’ offered a taste of this experimentation. A blend of gothic rock and Afrobeats, the song is unlike anything the Nigerian music industry has heard of. Rema positions himself as a dominant force, declaring his place among the industry’s elite.

This isn’t just a creative leap for Rema; it’s a strategic one. According to Spotify data, his tracks have been added to over 28.1 million playlists in the past year alone and saved to user libraries 24.3 million times. His audience skews slightly female, with a core demographic of young adults between 23 years and 34 years old. This dedicated fanbase positions Rema for audacious experimentation.

HEIS (a Greek word signifying ‘number one’, ‘first’, ‘unity’, and ‘supremacy’), reinforces this self-assured stance.

Producer Peace Aderogba Oredope, popularly known as P.Priime, becomes a co-conspirator in this sonic rebellion. Tracks like ‘March Am’, ‘Azaman’, ‘Yayo’, and the album titled track HEIS, weave gothic and death rock elements into the familiar tapestry of Afrobeats. Imagine Apala infused with gothic vibes, Hausa urban court music given a death rock makeover, Amapiano colliding with punk rock, or a sped-up Tanzanian Taraab sound merging with Indian flutes and drums – that’s the sonic kaleidoscope HEIS offers.

A track like ‘Ozeba’ leans towards Afro-punk rock, with Rema echoing the aesthetics of Travis Scott’s ‘FE!N’, where the song title becomes the driving force of the chorus. The featured artists, ODUMODUBLVCK on ‘War Machine’ and Shallipopi on ‘Benin Boys,’ further emphasise Rema’s commitment to sonic diversity. Each brings their signature sound to the table, ensuring a different experience.

Joey Akan, a Nigerian music journalist and founder of Afrobeats Intelligence, said on his X handle, “The culture has been subsisting on Amapiano, to the point of local erosion in the dance circuit. Instead of fighting DJs to stop spinning, our artists are cooking up a better replacement. ‘HEIS’ is just the first salvo of reclamation.”

Akan also suggests that Rema might be tired of being misunderstood. Despite the success of his debut album, ‘Rave & Roses,’ there seems to be a lingering question about his place in the industry.

This experimentation can be seen as a reaction to the current dominance of the Amapiano wave. Fans are yearning for a return to originality and songs that leave a lasting impact. Artists like Odumodublvck and Shallipopi have carved their niche by embracing unconventional sounds, and Rema seems to be following suit.

However, change isn’t always easy. Some fans, accustomed to the Amapiano-infused soundscape, have criticised HEIS on social media. A comment like @ThaBoyYom’s “There has to be a backstory… under no circumstance should a body of work sound like this” reflects this resistance to change.

But for others, like DJ Damifresh, this is exactly the point. HEIS is a challenge to conformity, a ‘reset button’ for the Afrobeats soundscape.

Motolani Alake, an expert on Afrobeats music, hailed HEIS as a masterpiece. He saw it as a diary of Rema’s extravagant lifestyle, a bold artistic statement, and a necessary evolution for the genre.

“It’s also a BOLD album, in its experimentation and Rema’s need to do something different. The soundscape has been crying out for someone to do exactly that since the turn of the year, and I’m glad it’s him that did it,” Alake added.

Alake highlights that the album is inherently Nigerian in character, rejecting claims that it caters to a foreign market.

“If there was ever an album that suits someone’s identity, it is HEIS and Rema. I’m one of those who stand by Afro-Rave not being a genre. And it’s still not, because it has no unique genre DNA and identifier. But now, I can call it a style,” Alake said.

HEIS might not be for everyone. The fast-paced, genre-bending tracks can be overwhelming. But for those seeking innovation and a break with the norm, HEIS is a sonic adventure. According to Rema Stats on X, HEIS recorded 1.8 million streams on its third day of release on Spotify Nigeria.

It is an album that pushes boundaries, challenges expectations, and sparks conversation about the future of Afrobeats. Whether a masterpiece or a misstep, HEIS is undeniably a bold experiment that will leave its mark on the music scene, say analysts.