For the second consecutive year, LivingTrust Mortgage Bank Plc has proudly secured the award for the Participating Financial Institution with the Highest Impact on MSMEs Accessing Credit for the First Time at the 2023 Development Bank of Nigeria Service Ambassadors Awards.

The bank, as stated in its announcement, extends credit to Micro, Small, and Medium Scale Enterprises as first-time borrowers through its credit origination system, maintaining an impressively low non-performing loan ratio.

DBN, the award organizers, emphasized that Livingtrust Bank’s performance significantly contributes to achieving DBN’s core objective of reaching MSMEs who might otherwise be disqualified due to a lack of credit history.

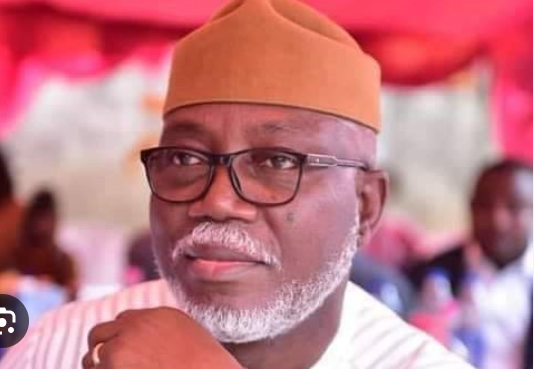

Expressing gratitude, Dr. Adekunle Adewole, the Managing Director of LivingTrust, thanked DBN for acknowledging the bank’s distinctive efforts in supporting the growth of underprivileged MSMEs.

Having received the award for the 2022 financial year as well, the bank is pleased with its two consecutive years of recognition.

Dr. Adewole highlighted the bank’s operational presence in communities where it stands as the sole financial institution, playing a pivotal role in fostering financial inclusion by providing credit to small businesses and stimulating economic activities in rural areas.

Looking forward, he expressed the bank’s commitment to continuing and expanding such impactful initiatives.

The award ceremony saw representation from LivingTrust Mortgage Bank Plc by its Executive Director, Dr. Olumide Adedeji; Group Head, Treasury and Institutional Partnership, Mr. Charles Olaluwoye; and Group Head, Legal and Corporate Strategy, Mr. Timothy Gbadeyan.