Chowdeck, Nigeria’s leading on-demand delivery platform, has launched a new bill payments feature and completed the full integration of Mira POS. The move marks Chowdeck’s strategic shift into fintech and a step toward becoming a super app in Nigeria’s digital economy.

Nigerian on-demand delivery platform Chowdeck is expanding its reach beyond food delivery, taking a bold step into the fintech space. The company has introduced a new Bills feature on its app, allowing users to buy airtime and data directly, marking its first consumer-facing financial product.

The announcement follows a record milestone—one million processed orders—which Chowdeck achieved just a week earlier.

At the same time, Chowdeck confirmed the full technical migration of Mira, a point-of-sale (POS) startup the company acquired in June 2025. In an email sent to merchants on Monday, November 10, the company revealed that Mira’s infrastructure and services are now fully integrated into Chowdeck’s system.

Together, these developments mark a strategic two-pronged rollout that positions Chowdeck to serve both consumers and merchants through a unified digital ecosystem.

—

A Two-Pronged Growth Strategy

The dual rollout signals a new phase in Chowdeck’s evolution. On one side, the new Bills feature deepens its relationship with consumers by embedding financial services into daily routines. On the other, the Mira integration strengthens its value proposition to merchants through unified delivery, in-store payments, and settlement tools.

This approach allows Chowdeck to operate not just as a logistics service, but as a technology and payment enabler, capable of managing both consumer spending and merchant transactions on its own rails.

“Frequency creates habit, and habit creates opportunity,” a source close to the company noted. “Chowdeck is leveraging its existing customer engagement to introduce financial services where trust and familiarity already exist.”

—

Building a Closed-Loop Financial Ecosystem

At the core of Chowdeck’s latest move is a push to create a closed-loop financial ecosystem. By enabling users to spend on food, bills, and digital services within the same app—and by powering merchants with integrated POS solutions—Chowdeck is building internal financial flows that remain within its platform.

This shift helps the company move beyond the thin margins of food delivery into higher-value financial services like digital payments, settlements, and merchant processing.

For users, the new feature simplifies everyday life—offering one app to order meals, shop groceries, and pay bills. For merchants, it offers operational efficiency through a single dashboard for transactions and settlements.

—

Backed by Fresh Funding

The company’s expansion comes on the heels of its $9 million Series A funding round announced in August 2025. The investment has provided the financial muscle for Chowdeck to scale its infrastructure, expand into fintech, and compete with leading players in Nigeria’s digital payment ecosystem.

With major fintechs like OPay, PalmPay, and Moniepoint dominating the consumer payments space, Chowdeck’s differentiator lies in its user frequency—millions of app opens every week from meal orders and deliveries. The company is now looking to convert that engagement into financial activity.

—

Challenges Ahead

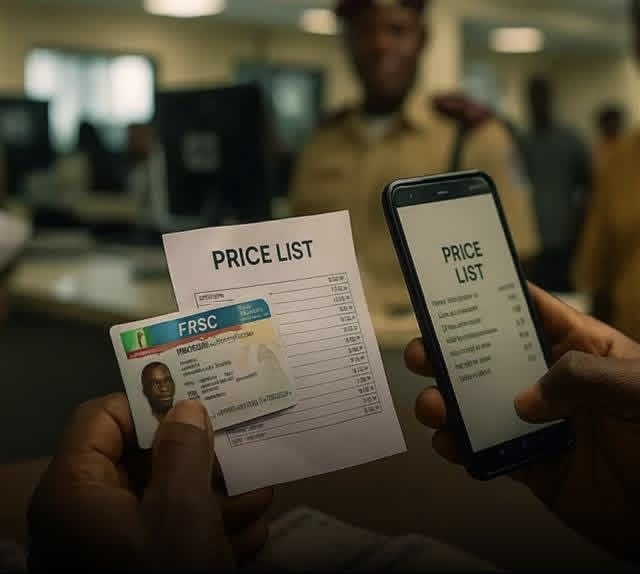

However, Chowdeck’s new direction is not without hurdles. Expanding into payments introduces regulatory scrutiny from agencies overseeing KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

On the merchant side, success will hinge on the reliability and uptime of its POS systems, settlement speed, and reconciliation accuracy. Maintaining the seamless experience that built its delivery reputation will be crucial in retaining both users and merchants.

—

The Bigger Picture: Nigeria’s Platform Wars

Nigeria’s technology ecosystem is entering a new phase of competition—one where every major platform is racing to become the country’s default digital lifestyle app. From payments to commerce and logistics, startups are converging on the same goal: owning the customer’s daily digital journey.

Chowdeck’s bet is that the road to fintech dominance begins with food. If the company can turn its delivery trust into financial confidence, it could emerge as one of Nigeria’s most influential homegrown super apps—bridging the gap between the wallet and the till.