Music star Davido has shared more details about his current predicament with baby mama Sophia Momodu as they continue to battle over the custody of their 7-month old daughter, Imade.

The music star shared all the text and supporting images on his Instagram page this morning and deleted everything an hour later.

In this piece he explains why he has acted in certain ways and also sheds more light on details about Sophia Momodu.

Read the lengthy (and detailed) piece below.

Birth of Imade Adeleke

When the second trimester of Sophia’s pregnancy was closing, she tortuously announced to me that she was in the family way.

My mind was bemused, and so was my soul confused. But I quickly realized that nothing more could be done to alter my status as a father-to-be. I knew that i was not ready to be a dad. Still, I adjusted myself to the realities of my new situation and the consequences of my past personal indiscretions.

I made the determination that I was going to be a good dad. I also reasoned that my blunder is not enough pretext to make me a husband. I was just 21. And so I decided to be a responsible dad without being husband to the mother of my baby. I never was in love with Sophia neither was marriage ever in the offing.

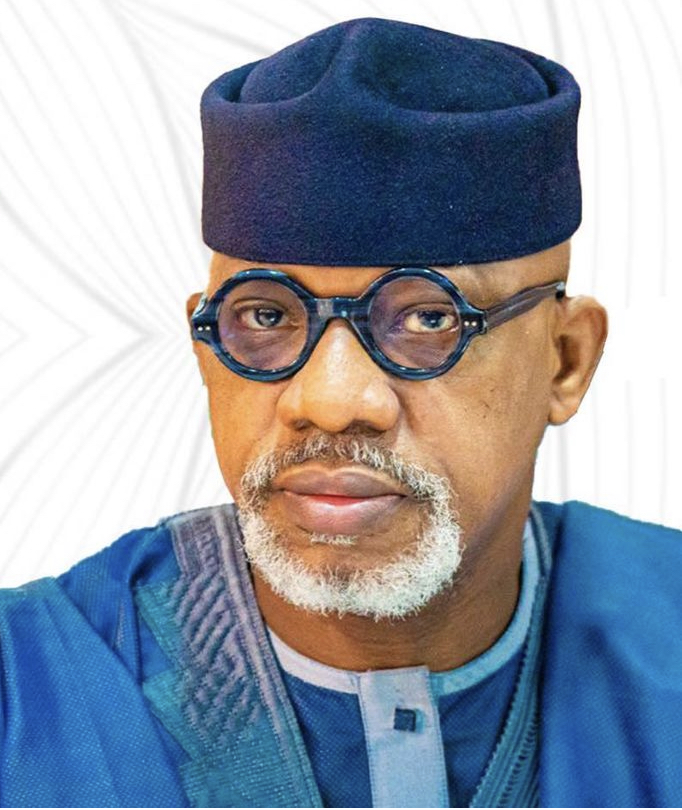

Without knowing for sure that I was the real dad of the baby, I entrusted Sophia to the services of a private hospital for both pre-natal and post-natal medical cares. An apartment at Lekki was leased for 2 years, and paid for by me. The burden of medical bills, feeding, transportation and sundry costs rested on my person. No family member of Sophia including Uncle Dele Momodu rose to help nor guide Sophia.

I own my property at Lekki and had allowed Sophia to stay in the house because she claimed that she knew nobody in Lagos and that her father was deceased whilst her mother was resident in Abuja. For real, Sophia was a drifter without a dime, education nor career. My compassion, ignorance, naivety and poor judgment had combined to make me a victim to a much older lady with super cunning sense that was mixed with a vicious and diabolical nature. I stand accused but calmly accepted my responsibility for the sad misadventure that caused me to be a seat-mate with Sophia on a plane that was flying nowhere.

All along, I have only been generous with Sophia without knowing for sure I was the father to the baby she was carrying. On May 14, 2015, Sophia delivered her baby named Imade. It was after Sophia had delivered the baby that DNA testing medically confirmed that I was indeed the biological father of our child named Imade.

Once this status was obtained, Sophia started to apply maximum financial demands on me. I bought all the baby things and fully furnished her apartment. Sophia knew well how to spend money and yet contributed zero to the vast expenses that I incurred. None in her family contributed even a fake coin to the cost of having Imade.

Uncle Dele Momodu, now the pompous moralist, never visited Sophia nor even delivered an ordinary greeting card to Imade nor to her mum. Throughout the many months that Sophia stayed at my house when she claimed she has no family in Lagos, Uncle Dele Momodu and his bossy wife never showed up at my house to say hello to either of us.

When the going was good, Sophia had told me plenty things about her uncle Dele Momodu that I need not repeat here. And she never invited me to go with her to visit him and I don’t have the knowledge that she ever visited him throughout the time she stayed in my house. She always explained that a visit to Uncle Dele was needless and unnecessary. Uncle Dele Momodu never liked, and still does not like Sophia. He is now just grandstanding because Sophia had a baby for a fairly prominent family and famous Davido.

The case of Mrs Momodu baffles me even more. Why did she not think it necessary to move to Sophia’s apartment to help her out and show her the tricks of motherhood when Imade was newly born. Not once did she visit Sophia and her baby until December 2015. She gave neither care, love nor financial support to Sophia. Now, at 7 months old, and a child with special medical needs, Mrs Momodu rushed to the Lagos Airport to make an awful botch of her standing as a mother: Mrs Momodu certainly not a good person. She put time and energy to prevent my daughter and I, the real father of Imade, from travelling aboard to keep an appointment with the American Hospital, Dubai. At the point of dying in November, 2015 Imade had been rushed to this medical facility in Dubai, where she received helpful and adequate treatment, and was duly returned to Nigeria, without any side excursions.

What then suddenly propels the fear or dangerous love of Mr & Mrs Momodu for Sophia? I deeply sense this couple never loved Sophia nor her late father. They also resent her mum, and probably are jealous that Sophia ever became a mum herself, and thus, wish that Sophia’s daughter who is also my daughter, must needlessly perish.

Where is the inherent value in a callous human ploy that directly intends to prevent a child from receiving necessary medical care aboard once the biological father, David Adeleke, the child’s grandfather and all my siblings who are uncles and aunties to Imade are booked to fly on this essential medical trip to which we have attached a restful family vacation? Sophia ain’t a member of our family, period.

Surely, Sophia was not with Imade when she first visited Dubai, and yet Imade was promptly returned to Nigeria. And no one said Sophia cannot come to Dubai except that I declared that I don’t want the trip to seem like a spousal get-away. Sophia ain’t my wife and I refuse to let any action conspire to make us look like a couple. She seemed unable or unwilling to pay her way to Dubai. Also, her boastful Uncle, alas, refused to volunteer to pay her way to Dubai. I never suggested to an elder what he should take up as his personal responsibility if indeed he cared at all for Sophia as his robust involvement in our odd relationship wishes to establish. Mr Momodu never bought the ticket but wanted to enforce his cosine to join my family on this Dubai trip.

Dangerous lights are furiously blinking red around my daughter, Sophia and my person. Uncle Dele Momodu and his wife are providers of the energy espousing the idea of a needless death to my daughter. I now say it loud and clear, should my daughter die, this strange couple are mainly responsible. Mr Dele Momodu should just leave me and my family alone! His daughter is not who had a baby for me, and he has been too much of an absentee uncle to Sophia to have any traction on the moral authority that commands the soul and heart of this matter. Sophia Never formally introduced him nor his wife to me, at any time. Why are they now crowding my space and that of my daughter?

Custody, Lifestyle and Imade’s Loss of Wellness

In May, the same month Imade was born, Sophia settled in her fancy apartment for which I paid a hefty bill for a 2 year lease. Her baby was healthy. And she seemed happy. I would take care of all the financial needs of Imade and still pay Sophia a living allowance of 300,000 Naira plus utility bills.

Within a matter of weeks, Sophia was missing and lusting for the streets of Lagos, especially the glitzy night life. She often left Imade home for clubbing, binge drinking and a life of debauchery and deviant living. She would sleep all day and party all night. When awake, she was addicted to the telephone and cannabis. She paid the baby no attention at all and seemed to despise motherhood and parenting.

Imade was in her custody for 2 straight months, unchallenged and uninterrupted, until the baby took badly and severely ill in July. Imade cried, ceaselessly, for 48 hours. She was rushed to the hospital where her condition confounded medical experts. Several tests were conducted on her and later on the mother. Medical reports, herein attached (exhibit 1), proved that Sophia’s blood was polluted to the maximum level with cannabis and she had by the process of breast feeding infected her child with complicated medical conditions associated with the use of alcohol and especially cannabis. The trouble spot for Imade was her lungs. She had difficulty breathing largely because of the contaminated breast milk and the severity of the “Second Smoke” of marijuana inhaled by the poor child.

Credit: Bella Nija