Comedian and actor AY Makun has spoken out about the recent controversy surrounding Netflix’s supposed halt in funding Nigerian original films.

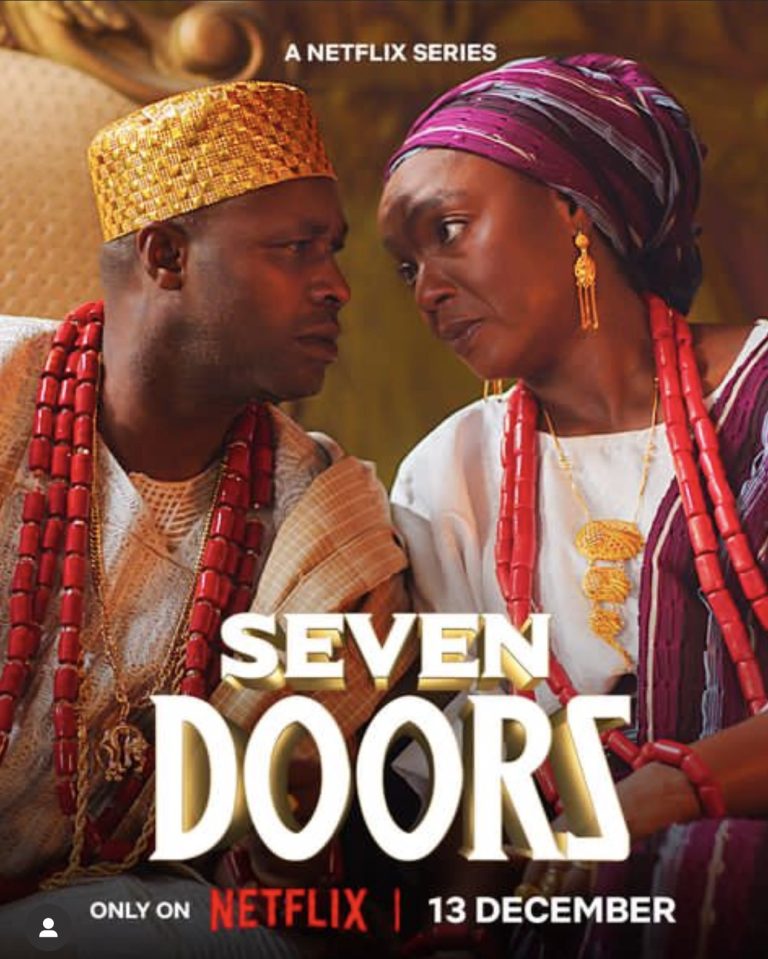

The controversy was ignited by filmmaker Kunle Afolayan, who claimed that Netflix had ceased commissioning Nigerian originals, raising concerns about the streaming giant’s commitment to the Nigerian market.

In an interview with Nollywood on Radio, Makun clarified that Netflix is not exiting the Nigerian market but is likely re-strategizing its approach due to financial concerns.

“I had a meeting with Netflix recently and it was never mentioned to me that they are opting out of business in this part of the world,” Makun stated.

“At the last meeting, we discussed my next project and how they can be a part of it. I also do not want to believe strongly that they are leaving Nigeria.”

Makun noted that Netflix’s struggles in Nigeria stem from financial challenges.

“The truth is if you are doing business in a particular region and you are not making money but spending much more than you’re making, you would want to re-strategise. That is what is going on with their system and structure,” he said.

The comedian explained that Netflix’s spending in Nigeria has far exceeded its earnings, prompting the company to reassess its business model.

He pointed to the widespread practice of subscription sharing and low subscription rates as key factors contributing to Netflix’s challenges in the country.

“For example, the subscription basis for Netflix in a country that has a population of over 200 million people is just about 300,000, so there is a leakage somewhere that needs to be corrected,” Makun noted.

He added that many Nigerians are accessing Netflix content through shared subscriptions rather than purchasing individual subscriptions.

“You would see a person with a Netflix subscription sharing with several people, so that’s the problem. It is not just about the filmmakers,” Makun concluded.

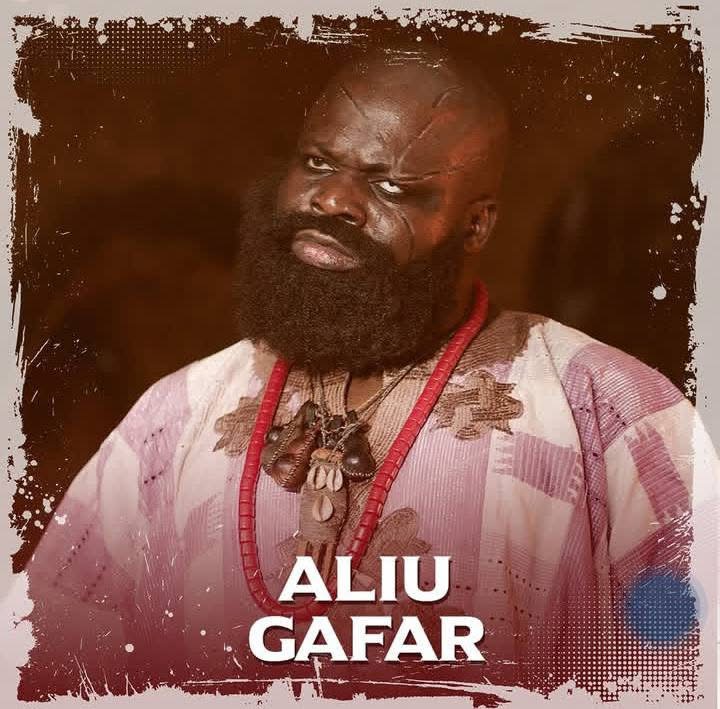

Aliu’s journey as an actor was not without its challenges. Losing his father at a tender age, he had to live with extended family members, who introduced him to the world of church productions. He played the role of King Pharaoh on several occasions, which helped him develop his acting skills.

Aliu’s journey as an actor was not without its challenges. Losing his father at a tender age, he had to live with extended family members, who introduced him to the world of church productions. He played the role of King Pharaoh on several occasions, which helped him develop his acting skills. In 2000, Aliu joined Ogboluke and Jide Are, where he received professional training as an actor. He honed his skills in stage theatre and screen, and to this day, he still performs on stage, crediting it as the foundation of his acting career.

In 2000, Aliu joined Ogboluke and Jide Are, where he received professional training as an actor. He honed his skills in stage theatre and screen, and to this day, he still performs on stage, crediting it as the foundation of his acting career.

Accolades and Recognition

Accolades and Recognition