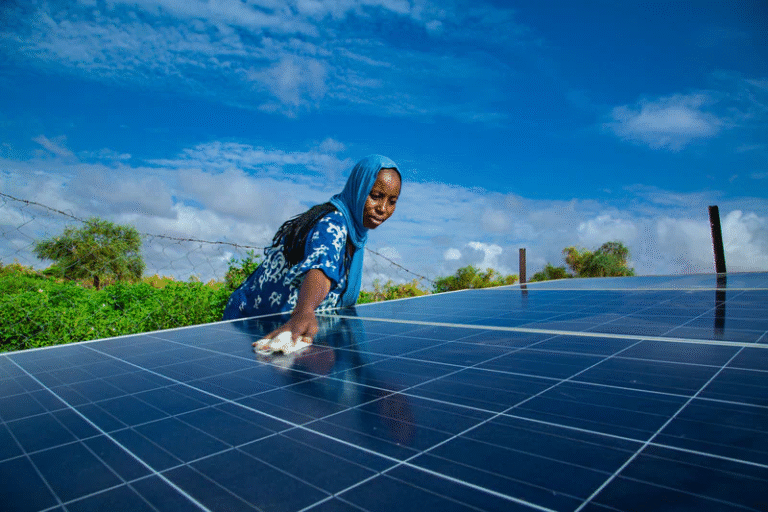

Africa’s Solar Paradox

The European Union has spotlighted a stark contrast between Africa’s vast renewable energy potential and the level of investment it attracts. With 60% of the world’s prime solar resources, the continent draws only 2% of global energy investment. Barriers such as high capital costs, limited funding, geographic challenges, and supply chain bottlenecks continue to impede progress.

Currently, 600 million Africans lack electricity, a gap that looms even larger as the population is projected to double by 2050. Ensuring affordable, sustainable energy is increasingly urgent—not just for economic growth, but for meeting global climate targets.

NDLEA Cracks Cocaine Ring at Lagos Airport

In Lagos, the National Drug Law Enforcement Agency (NDLEA) intercepted 2.30 kilograms of cocaine cleverly concealed within automobile parts at Murtala Muhammed International Airport. A freight agent and an auto parts dealer were arrested following the seizure, which uncovered 48 cocaine pellets intended for export to Gabon. NDLEA emphasized the operation as part of ongoing efforts to clamp down on drug trafficking through Nigeria’s transport corridors.

Crayfish Prices Surge Amid Market Pressures

Household staples are feeling the pinch as crayfish prices in Lagos continue their upward climb. Traders predict a paint bucket of crayfish could cost between N15,000 and N20,000 by December if current trends persist. Fuel hikes, transportation costs, poor roads, and seasonal shortages are squeezing margins and reducing consumer access to this essential ingredient, highlighting broader challenges in Nigeria’s food supply chain.

Digital Leap for Humanitarian Services

The Federal Ministry of Humanitarian Affairs and Poverty Reduction has gone live on the 1Government Cloud Enterprise Content Management System (ECMS), marking a pivotal step toward paperless governance under the Nigeria First Policy. Minister Dr Bernard Doro described the initiative as aligned with the Renewed Hope Agenda, emphasizing efficiency, responsiveness, and transparency. Head of the Civil Service, Dr Didi Esther Walson-Jack, hailed the adoption as a milestone, noting that 19 ministries already using the system will no longer accept paper-based correspondence.

Global Fashion Moves: Ralph Lauren Acquires South Africa’s Polo

In corporate news, the Ralph Lauren Corporation has completed the acquisition of South Africa’s Polo brand, resolving longstanding trademark disputes. The integration promises to position the local label within the global luxury market while preserving jobs.

Atiku Abubakar Warns on TSA Appointment

Former Vice President Atiku Abubakar has expressed concern over the appointment of Xpress Payments Solutions Limited as a new collecting agent under the Treasury Single Account (TSA). He described the move as a “dangerous revival” of monopolistic revenue structures, warning that it risks turning Nigeria into a “private holding company” controlled by vested interests. Atiku criticized the timing and secrecy of the decision, calling it “state capture masquerading as digital innovation.”

The launch has generated considerable interest, with crowds of shoppers gathering to explore the store and experience the global retailer’s offerings firsthand. This expansion signals Walmart’s commitment to strengthening its presence in South Africa and providing consumers with greater choice and convenience.

The launch has generated considerable interest, with crowds of shoppers gathering to explore the store and experience the global retailer’s offerings firsthand. This expansion signals Walmart’s commitment to strengthening its presence in South Africa and providing consumers with greater choice and convenience.